The Ministry of Finance in Mexico last August 31st, 2018 published that extends the cancellation process of CFDI’S, which was established initialy on September 1st in conjunction with the supplement of payments, now this obligation will start on November 1st, 2018.

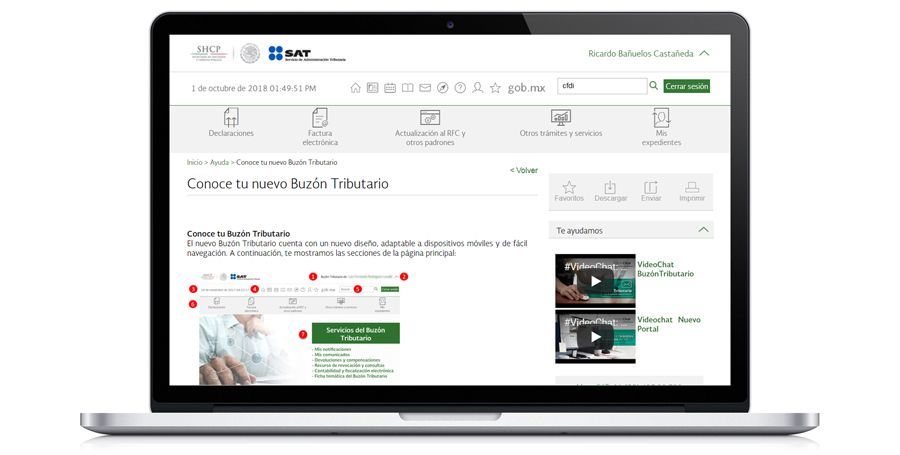

The Ministry of Finance in attention to the requests of the taxpayers and the billing providers authorizes the extension, it is suggested that the taxpayers prepare themselves and can anticipate this new obligation. For this new obligation it is obligatory that the emails are valid to receive notifications in the “Buzon Tributario” (tax mailbox).