On October 13th 2017, the Government presented in Parliament the draft law No. 401/2017 related to the Portuguese State Budget Proposal for the year of 2018. We present below a brief description of the measures that we consider more significant:

Corporate Income Tax (IRC)

Capital gains obtained by non-residents

It is pretend to become subject to taxation capital gains obtained by non-resident entities without head office or effective management and without a permanent establishment in Portugal, with the transmission of parts of share capital or similar rights in any non-resident entities when, at any time during the 365 days earlier, the value of such parts of share capital or rights arising, directly or indirectly, from the holding in more than 50% of real estate or real property rights, which are located in Portugal (unless the real property is assigned to agricultural, industrial or commercial activity, which does not consist in the purchase and sale of real estate).

Bad debts

It is proposed that the bad debts claimed in insolvency proceedings will be able to be considered as expenses or losses of the tax period, although the respective accounting recognition has already occurred in previous taxation periods keeping the condition of not having been booked impairment loss or this is insufficient, in the following situations (in addition to the situations where bankruptcy is declared with limited character):

- When it is determined the closure of insolvency proceedings of goods.

- After the final assessment, resulting in non-payment of the credit.

- When, in the judgment of homologation of the insolvency proceedings, be provided the non-payment of credit (also applicable in the case of special process of revitalization).

Personal Income Tax (IRS)

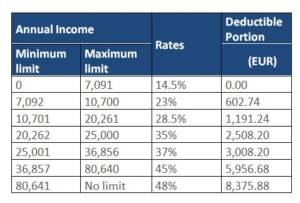

Rates

The IRS rate is now made up of seven bands of tax, according to the following table:

Education vouchers

The values assigned to the title of Education Vouchers for the employer to its employees with descendants aged between 7 years and 25 years, will be taxed on totality as income from employment. Currently, these vouchers benefited from a tax exclusion up to a maximum of €1,100 per year, per descendant. Shall remain in force only the exclusion of taxation on Childhood Vouchers, apply to descendants under the age of 7 years.

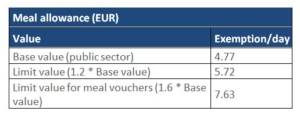

Meal allowance

Is intended to be increased the value of the meal allowance excluded from IRS taxation to €4.77, which corresponds to the value of the meal allowance in place for the State employees. When assigned in meal card, the value exempt from IRS is increased to €7.63.

Value Added Tax (VAT)

Bad debts

It is intended to change the possibilities that allows taxpayers to deduct the tax on the deemed irrecoverable credits. It will be possible for taxpayers be allowed to deduct the tax on:

- Deemed irrecoverable credits in insolvency proceedings, when the insolvency is declared with limited character, or when it is determined the close of the proceeding for lack of goods or after the final assessment which results in failure of the credit payment.

- In the insolvency proceedings or in special process of revitalization, as handed down sentence for approval of insolvency or recovery plan, providing the non-payment of the credit.

It is proposed to eliminate the possibility for taxpayers to deduct the tax related to irrecoverable credits in insolvency proceedings after the transit in trial of the final sentence of verification and graduation of credits. Indeed, this deduction becomes possible only when in the final sentences