Currently, the implementation of the Immediate Information Supply (SII) has meant an improvement and impulse of the use of electronic means in the management of the Value Added Tax (VAT). Thanks to the SII, a new system is possible to keep VAT registration books with the almost immediate sending of billing records through the Electronic Office of the Spanish Tax Agency.

This system has been a new challenge for taxpayers obliged to use it, especially due to the short period of 4 days that is available to send the records of Issued and Received Invoices.

In this sense, and in order to improve the functioning of the SII since its entry into force, the Tax Office has been updating the system with new versions and validations.

Thus, on June 20, the Department of Tax Management held an information session on the new validations that will take effect on October 1, 2019 and that were published on the AEAT portal on May 17.

Among the main aspects that could affect the usual operations of our customers are the following:

1) XML records are not modified. Operations will continue to be recorded in the same way, since new fields will not be created and new information will not be provided.

2) The list of questions FAQ.3 has been updated, coordinating the same with the transfer of data to the invoice register.

3) The new changes affect both the Books Registry of Issued and Received Invoices, with no effect on the rest of the eBooks Registry: Intra-Community Transactions and Investment Assets. This is aimed at improving the quality of the information provided.

The main modifications refer to:

- Validations of the different regimes. The system will not accept any error record, forcing the taxpayer to correct it and only admitting the “correct” status. In order to facilitate the process, the program will identify the error when it occurs so that it can be corrected immediately and the user can continue all the way to its completion and presentation.

- Different keys of the VAT special regime and its operations that affect -as we mentioned before- the Book of Issued Invoices and the Received Bill of Invoices. Operators must review these codes according to their operations.

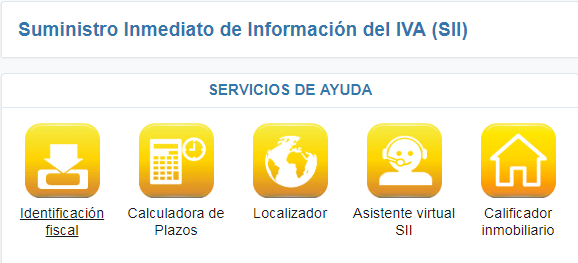

5) In addition, the AEAT has enabled a series of aid tools related to the SII and the VAT regulations, available to the taxpayer:

6) Finally, it should be noted that, in the future, the system is expected to offer more contrast information. In parallel, soon, they will begin to issue a “draft of 303” – called Pre303 – with all the information provided to the SII. Said document will not be authorized for all taxpayers, but only for those included in the Monthly Return Registry (REDEME) and voluntary taxpayers, and in no case will it be generated for taxpayers who are in pro-rata, differentiated sectors or cash-flow sectors. Said draft may be modified by the taxpayer, except for census errors.

In short, these new validations require a greater review of each of the different operations reported in the SII. That is why during this time until its entry into force on October 1, it is advisable to review the operations of each company and contact an expert advisor to help you with the correct completion of the records in the SII, as a from now on the AEAT will automatically reject the previous records “Accepted with errors”.

You can get more information on the new developments in the following link of the AEAT portal: