In a few weeks the Corporate Income Tax (CIT) will be due in Spain for companies with yearend Dec.31st 2019. According to the rules of the CIT in Spain, based on the OECD guidelines on transfer pricing, Spanish subsidiaries are obliged to inform and properly document, on an annual basis, the transactions made with group companies (loans, services, management fees…).

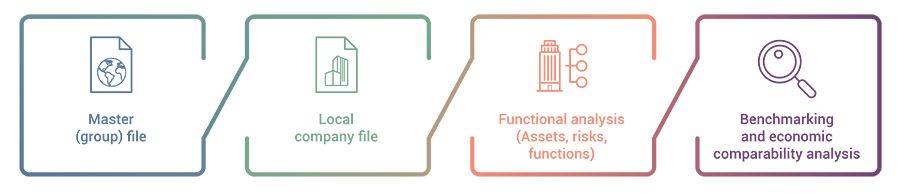

The specific scope and content of this obligation varies depending on the net amount of the turnover at global group level, and the type and amount of the related transaction, but generally it includes:

In the case of financial transactions (loans), the OECD has introduced additional requirements that may require further details, in terms of comparability and key ratios, on the financial the structures used.

The important fact here is that this set of documentation must be available to the Tax Agency after the end of the voluntary period of filing the CIT return. For example, a company whose fiscal year ends on December 31st, 2019, should have the transfer pricing documentation for 2019 available from July 27th, 2020, in case it is required by the Administration for further review.

The CIT Act provides penalties both if you do not provide the transfer price documentation and or if the information provided is incomplete, inaccurate or provides false data. It also establishes fines when the market value contained in the documentation does not correspond to the one declared.

Any valuation adjustment made would imply a penalty of 15% on the amount of the latter, plus the corresponding interest for late payment. Even if there is no valuation adjustment, the penalty could be between EUR 1,000 and EUR 10,000 for each omitted data or set of data, with the ceiling of the smallest amount between 10% of the total amount of transactions and 1% of the net amount of the turnover.

By means of the regulations related to Transfer Pricing, the authorities seek to increase tax transparency and avoid the risks derived, with the aim of increasing control of fraud in this type of operation. Ignorance of these regulations, or non-compliance, has important consequences for the societies operating in our country.

All information contained in this publication is up to date on 2020. This content has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this chart without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this content, and, to the extent permitted by law, AUXADI does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this chart or for any decision based on it.